Bootstrapped vs Funding. Should Your Startup Raise Venture Capital? [Full Guide]

- Should Every Tech Startup Seek Funding?

- How Top Tech Startups Started?

- Most Tech Startups Were Bootstrapped…

- Investors Don’t Invest in Ideas But in These 2 Things

- 2 Questions to Ask Yourself Before Looking for Funding

- Is It Possible to Raise VC Money at The Beginning of Your Startup Journey?

- Do I Really Need VC Money for My Tech Startup?

Should you bootstrap, or should you start a VC-backed company? This is quite a controversial topic, and many first-time software founders get it wrong.

With my partner, we bootstrapped 2 of our own SaaS products by re-investing our agency profits.

On the other side, my agency worked with many multi-million dollar funded startups, including Shark Tank show winners like YumlbeKids.

And I saw first-hand how both approaches work and their pros and cons. In this article, I’ll tell you how many successful tech startups are actually VC-funded.

In which cases should you consider funding, and in which cases should the only option be to bootstrap? At what point in your business journey should you consider funding at all… And finally, what are the two main criteria for getting funded as a tech startup?

I’ll answer all these questions in this article and many more.

Should Every Tech Startup Seek Funding?

Did you know that less than 1% of successful tech companies worldwide are VC-funded? And most people who are rich did not raise venture capital.

Yes, that’s true that every trillion-dollar company that exists right now in the world was VC-funded. And yes, some specific types of SaaS startups, like Facebook, Uber, and Amazon, can not be successfully launched without professional funding.

Those are so called “Conquer and Prevail” type of business ideas that need to take most of the market share to be successful. However, in most other cases, 99% of businesses should not raise venture capital. Why?

Let’s start with a few examples of super-popular software companies.

How Top Tech Startups Started?

Airbnb founders couldn’t raise money at first. So they started selling Cereals and made $30k to build an initial product version. Only after having the first users were they able to raise VC capital.

Before starting Stripe, Patrick and John bootstrapped and sold a successful startup for $5 million. This track record allowed them to get quick seed funding for Stripe.

ClickFunnels founder Russel Bruson started his entrepreneurial career with a tiny software called ZipBrander, which he built with a few hundred dollars by hiring a remote freelancer. Every Russel’s software product was bootstrapped and grown by reinvesting. Including ClickFunnels…

Swedish entrepreneur Daniel Ek sold his online marketing agency and re-used the money to build and launch an initial version of Spotify.

Investors rejected Reid Hoffman multiple times with his first software ideas in 1997. So he grew his career with Apple, Fujitsu, and later, Paypal.

Then, he returned to the startup world and bootstrapped LinkedIn. His track record allowed him to grow LinkedIn fast and get VC money.

Mint.com founder left his tech position with savings for over one year in his pockets. He closed himself in the room for nine months and built an alpha version on his own. Only then did he have partners joining in and getting VC money.

In 1994, Jeff Bezos’s parents invested in his idea $250k, which was a good part of their life savings. In 1995, when sales went up, Amazon got its Series A funding.

Houzz, the world’s leading home design platform, started by a couple in 2009 as a side project.

Adi and Alon spent their time and money and turned it into a successful business.

Their first 2 million in VC money they got in 2010.

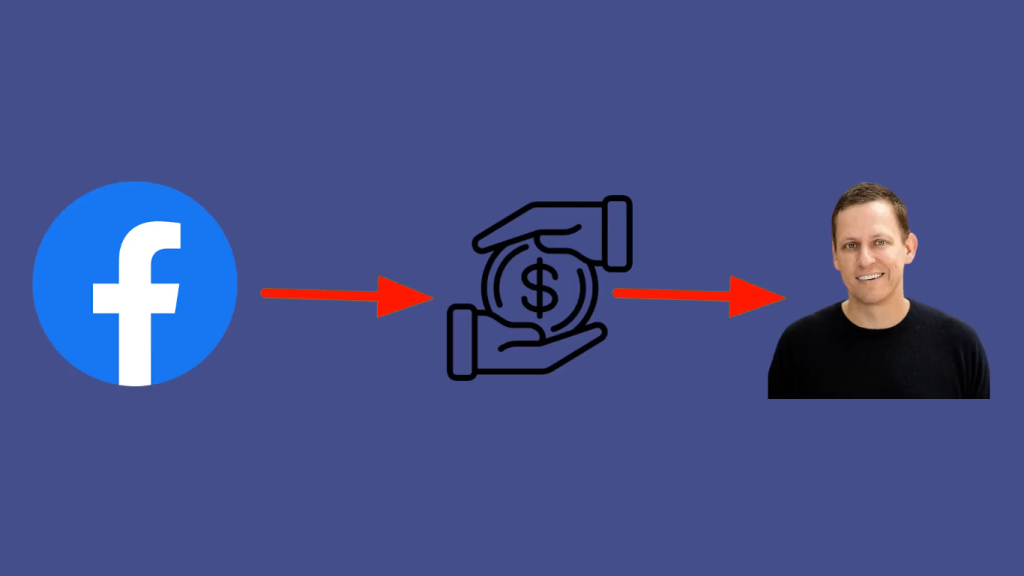

Facebook received its first significant funding from Peter Thiel, who invested $500,000 in the summer of 2004. At that time, Facebook had around 1 million users.

37signals (web development agency) started project management software named the Basecamp while still doing client projects. Now, it’s a multi-million-dollar business with over 3 million paid accounts. They never looked for professional funds.

For two years, Larry Page and Sergey Brin were prototyping their algorithm for a web search named PageRank, which yielded much better results than Yahoo.

Only then in 1998, they were funded for the first time.

I can go on with more examples, but you probably got an idea…

Most Tech Startups Were Bootstrapped…

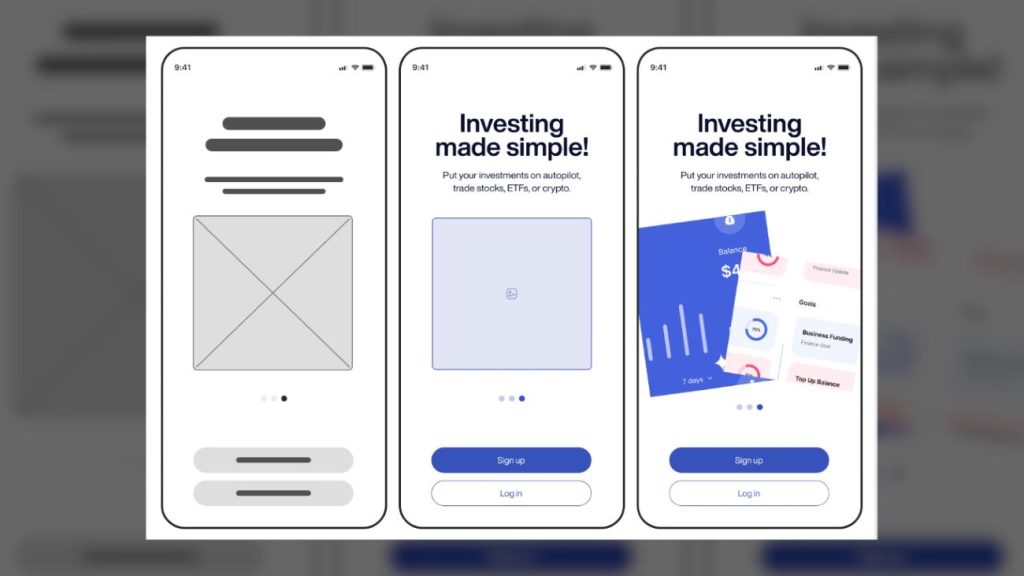

Most famous multi-million tech startups were bootstrapped! Most of them had humble beginnings. Some founders did it all by themselves, while others had some savings to build an initial software version by hiring developers.

Also, some of them built their initial product version in a way that didn’t require actual technology. Only once they sold their idea did they reinvest the first money to build software.

Yes, a few of them were lucky to get initial funds from seed rounds. Little money, $20-50k to build an initial product version and gain some traction. And, if you research a bit deeper, those few lucky founders were not doing it for the first time… Most of them had something to show to investors from their entrepreneurial journey.

Investors Don’t Invest in Ideas But in These 2 Things

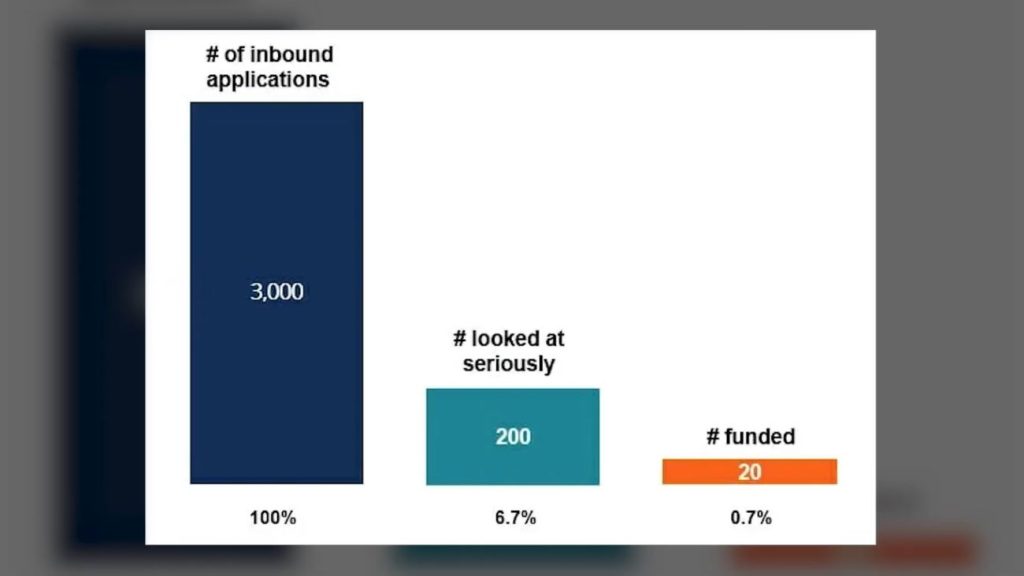

It was never easy to get money from professional investors… Yes, it was a bit easier a few years ago when venture capitalists competed to fund tech startups. But even then, it was quite a challenge, and only a small percentage of ideas were funded.

Now, the unicorn bubble is bursting. You will spend years trying to sell your idea to investors, having only a startup pitch deck in your hands.

All these agencies selling pitch deck services for $30k are still doing pretty well. I’m so impressed by how many startup newcomers are so naive and believe they can raise it with awesomely designed 12 slides…

Investors don’t invest in the next cool idea.

They invest in two things:

- Startup Traction. It might be revenue, paid users, or some interest and support from the users.

- Founders track record.

If you have already built an MSP (Minimum Sellable Product) and made money with it, then your chances grow exponentially.

Or, if you are, let’s say, Stripe founder and now want to build another thing, whatever your idea is, you’ll have a line of investors willing to put their money on the table. In other words, they invest in results and actions. Not in ideas alone.

That’s precisely why, in our software acceleration program, we include a good bunch of development hours. So that students can graduate with a working prototype to show to potential clients, partners, and investors.

Just an idea, even with a well-defined product strategy, won’t make it. You need something to show for real. Something that works.

So, what should you do instead?

2 Questions to Ask Yourself Before Looking for Funding

First of all, start lean and do whatever you can with your own resources. Then, when you cross the pre-revenue stage or at least get the first users, decide whether you want or need an investment.

VC money needs to be optional for you. To speed up your growth. VC money comes to those who will succeed with them or without them. VC money needs to be considered as a growth strategy and not as the only option for a business to survive.

So it all comes to two questions now:

- Is it possible to raise VC at the very beginning of your software journey?

- and Do I really need VC money, then?

Now, let’s consider each of these questions separately.

Is It Possible to Raise VC Money at The Beginning of Your Startup Journey?

In 99% of cases, NO.

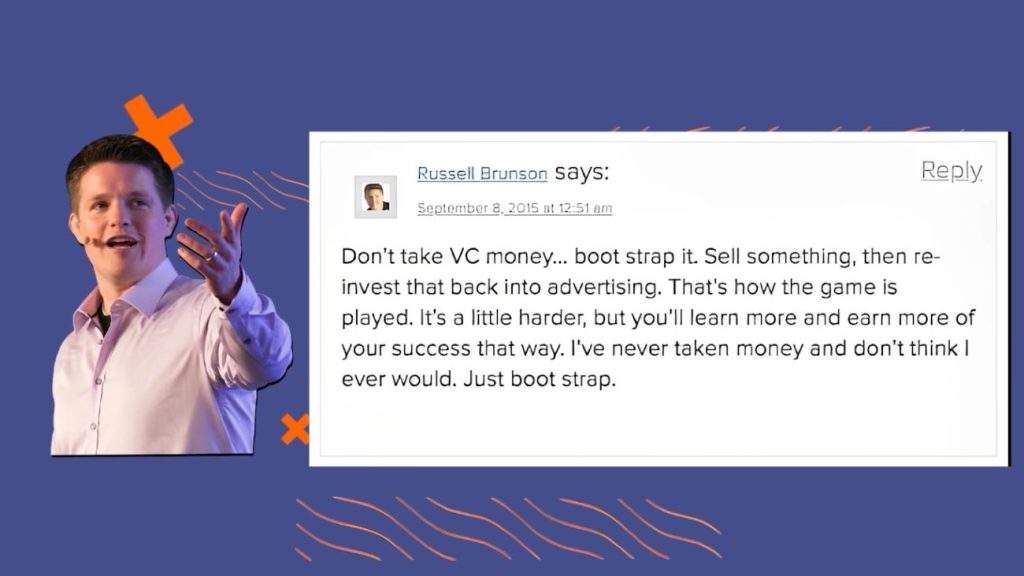

If you have no track record as an entrepreneur and have only a pitch deck to show to investors, forget about it. It’s much easier to sell anything to anybody than just an idea to professional investors. And don’t just get my word for it. Here is what Russel Branson, ClickFunnels founder, responds to those seeking investment:

Do I Really Need VC Money for My Tech Startup?

Now, after you got some traction, users, and revenue… This is the point where you can go back to this question for the second time.

And here you’ll have two options:

- Start a bit slower, grow organically, and re-invest back all your profits. Keep full control of your company and worry only about satisfying your customers. And eventually, benefit from all the fruits in the end. 100%

- Or, instead, as a second option, you can take a $10 million check from VC. Remember, the moment you cash it in, you owe them 10x of that — $ 100 million. Then, you also lose part of your company control and now need to worry about investors and customers. What is even worse is that investors need to be put first.

Both options are okay. But the moment you start making revenue with your SaaS product, you’ll be much more hesitant to take VC money. And the rest I’ll leave up to your personal preferences, goals, and vision…

If you are interested in having my in-house developers build your SaaS product or maybe having me as a mentor? Then contact me and we will analyse your case in detail!